On June 1, Vice President Kamala Karris announced the Action Plan on Global Water Security for the first time (which is historic for the United States), and it sees water security as a very important security and political issue. We are far behind schedule in terms of the United Nations’ sustainability goals, and you can see in the newspapers and in the headlines that the climate is causing more and more turbulence. Numerous scientists have already confirmed that we no longer have time to counteract climate change and that this requires increasing sacrifices and also economic sacrifices.

Global Water Security has been defined by the United Nations in the Sustainable Development Goal No 6 that this means water security, access to water for 8 billion people!

1 The Situation

Up till now, since the invention or the emergence of the capital markets, so-called natural capital or environmental risk has never been priced in. This has only been happening recently and slowly. However, you still can’t invest in climate. You can’t invest in socially responsible investment (SRI). These are all concepts that are fine, but there is no globally recognized framework for ESG and SRI. It’s all still intangible.

Water, on the other hand, is a tangible asset and you can invest in water - in water supply. The problem is that the media focus and also the investor focus is still on ‘climate’. The bridge has not yet been built between the actual sustainable investment opportunity and the distinction of the esoteric topic of ‘climate’. Climate is intangible. However, climate is actually expressed through water. Such as through aridity, through drought, through changing the biosphere. Through sea level rise, which is a very big problem. The melting Arctic and Antarctic, which raise the general global water level. In 2020, 60 percent of the world’s population lived within 60 km of the coast. Imagine if Miami goes underwater, Hong Kong goes underwater and theses scenarios are not yet properly consolidated and communicated in the mass media. Yet it would be urgent in time that awareness is created and it stands to reason that when we deal with climate change and global warming, all of this is expressed through water.

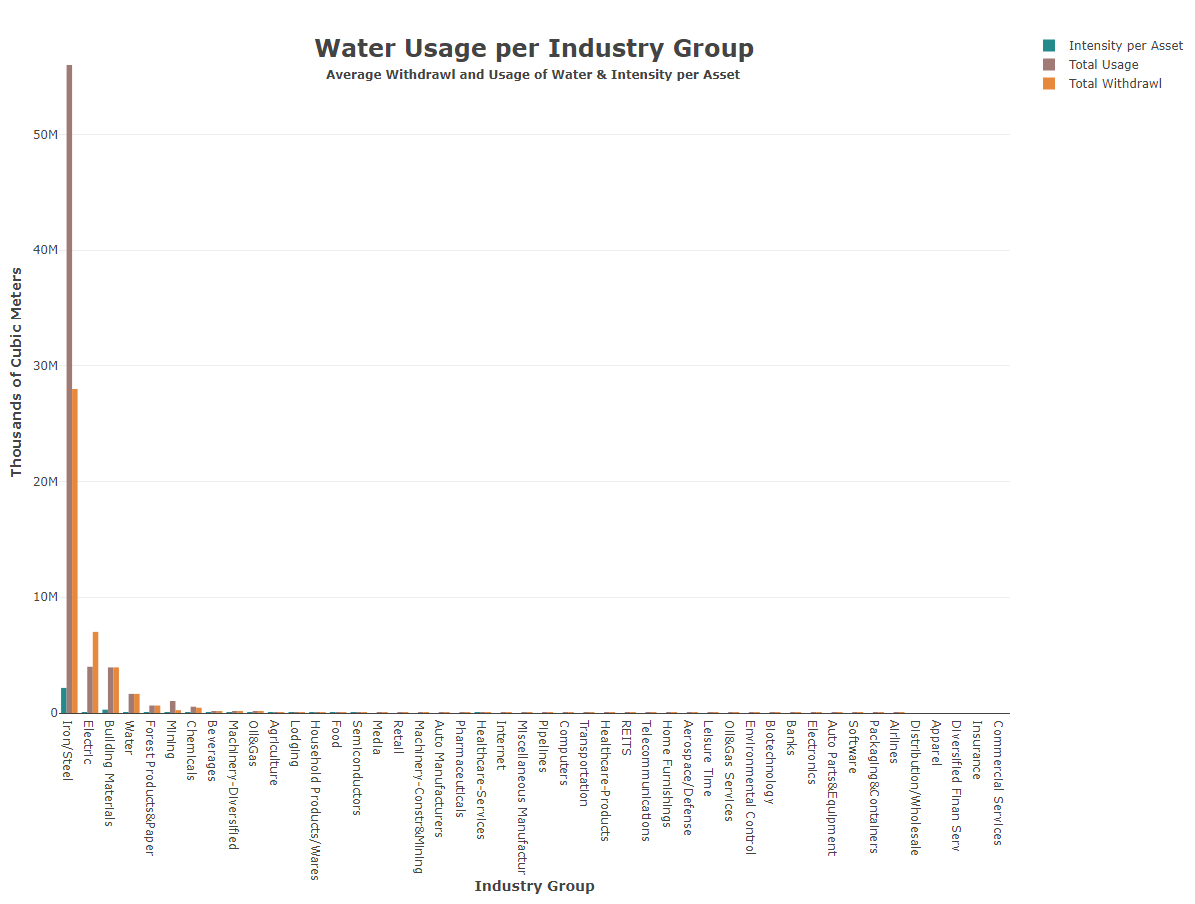

This simple overview shows how much water is used on average per industry sector

# Get Data

mydb <- connect_to_db()

usage <- DBI::dbReadTable(mydb,"eco_ticker_water_usage")

DBI::dbDisconnect(mydb)

# Industry Group USAGE

usage %>% dplyr::group_by(industry_group) %>%

dplyr::summarise(`Total Usage` = mean(total_water_use),

`Total Withdrawl` = mean(total_water_withdrawl),

`Intensity per Asset` = mean(water_intensity_per_asset)) %>%

tidyr::pivot_longer(-1, names_to = 'group', values_to = 'values') %>%

plotly::plot_ly(x = ~industry_group, y = ~ values,

type = 'bar',

color = ~group,

colors = aikia::aikia_palette_main()) %>%

plotly::layout(annotations = list(

list(x = 0.5 , y = 1.0, text = "<b>Water Usage per Industry Group</b>", showarrow = F, xref='paper', yref='paper',

font = list(size = 24)),

list(x = 0.5 , y = 0.95, text = "<b>Average Withdrawl and Usage of Water & Intensity per Asset </b>", showarrow = F, xref='paper', yref='paper')),

xaxis = list(categoryorder = "total descending",

title = "<b>Industry Group</b>"),

yaxis = list(title = "<b>Thousands of Cubic Meters</b>"))

2 The Idea

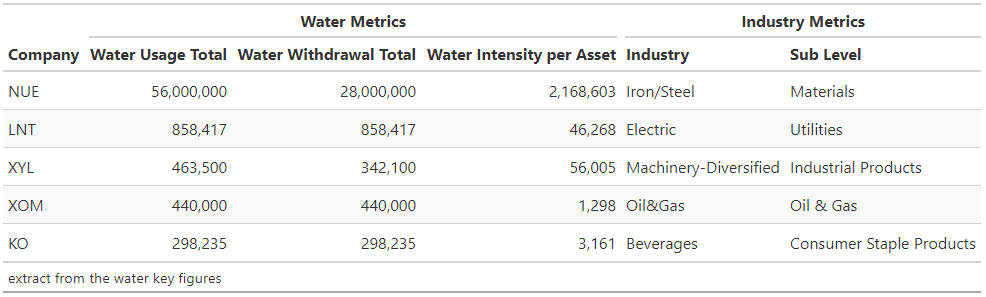

Here, we look broadly at individual companies. Because of ESG data disclosures, companies report how they treat water. We can take various water metrics from the ESG basket that show by qualification and quantification measurement the exposure to water risk of individual companies. It starts with -> how much water a company uses? -> How much water is extracted from groundwater? -> How much fresh water is needed? -> How much water is recycled? -> and finally, if and what policies exist in the company on how water is to be treated?

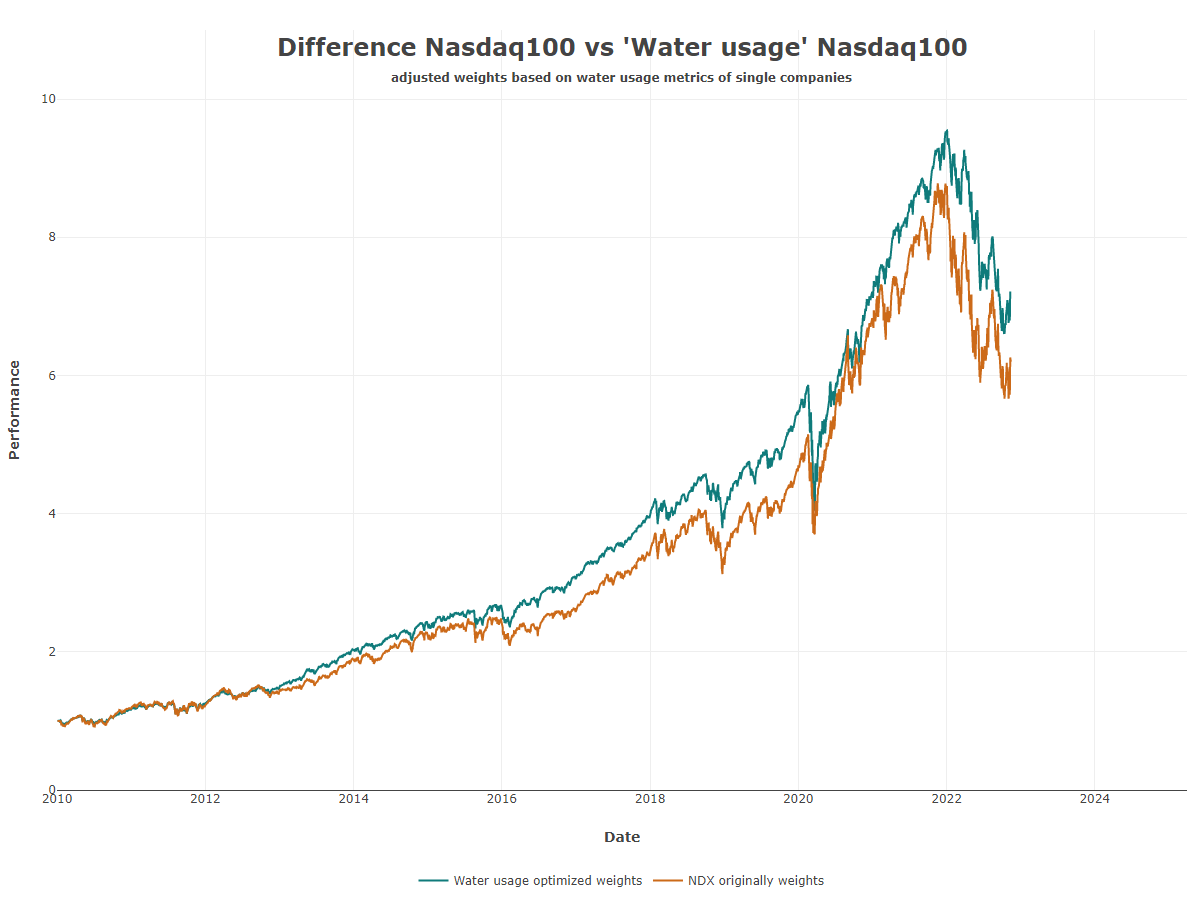

From these individual components we can more or less put together an evaluation methodology. So we can put together a selection universe that up to now have not priced in climate as a financial risk, in the form of water. This will allows us to build a new Generation of the usual flagship indices (NDX/MSCI/etc), which is even more granular and more sophisticated in how environmental risk affects countries and constituents.

3 The Thesis

The methodology suggests that the investment universe of individual companies should be rebalanced so that good water managers are overweighted and bad ones are underweighted. And the thesis is that if you position yourself well today and the tracking error to the main indices is low, then you are already participating in the institutional indices with similar performance. In this approach with a slight out-performance already. But as soon as the price of water goes up and the water scarcity increases, you will of course benefit from the alpha in the long run.

The water footprint of the new index is lower and a lower water footprint also means that the companies have a lower carbon footprint and that of course again brings the interconnectedness, the dependency, the interplay between water and carbon. In other words, companies that are already better positioned in terms of carbon and water are simply better positioned for the future, because they are already aware of the issues and take appropriate action to safeguard themselves.

4 Regulatory driven Water Investments

Around the millennium year 2000, the first Generation 1 or V1 ETFs and mutual funds of this topic were launched. However, all of these invest in the same baskets of about 30 to 50 so-called waster stocks, with a very heavy weighting in the U.S. and Europe. All these companies either manufacture or produce water technology, water utilities, or water treatment or filtration systems. Likewise, the trend topic desalination seems to be getting out of style now because it’s still very cost intensive and energy intensive. We also have an additional, big problem, because when water is withdrawn from the ocean, after desalination, the so-called brine is normally returned back to the ocean. With that, you have a very high salinity that destroys marine life. Nevertheless, there are states like Kuwait, Qatar, or even in Dubai, where desalination is right up front. However, the water itself has poor quality as it has no nutrients. So, we still have to work on this and find better technologies.

For investment purposes, there are various funds in which to invest, with some of these now somewhat aged Generation 1 funds having several billion € in fund size.

Alternatively, you can of course invest in individual stocks for this, such as American Waterworks. Equivalently there are many good utility companies, which are so-called good ‘bread & butter’ stocks and are often also dividend kings. But these are the only opportunities to invest in water right now.

5 Conclusion

Recently, investor demands and capital market requests are simply getting higher as ESG demands continue. The existing comparison and investment capabilities don’t seem good enough anymore. As an alternative here, the recently described concept looks at the equity universe and how all the companies in that universe treat water. And because of the way these companies protect the environment and the climate, we can establish a 2nd Generation of comparative (investable) indices that focus on preserving our environment and provising additional alpha as soon as water becomes scarce.

All these companies are not necessarily following the United Nations Sustainable Development Goal Number 6, but with today’s knowledge it is quite important that you invest in companies that have an approach like UNSDG6 “Ensure Access to Water and Sanitation” and have written it all over and that they are really aligned with it. Just to emphasize it again, the UN is the only globally recognized framework to date that is not open to wide interpretation. Since it was issued by the UN, there is no special conflict of interest with the capital market. In contrast with ESG and SRI there are now all the companies saying WHAT it is and each of the companies has its own methodology, its own data for it. However, there is still no consensus on the definition of ESG and SRI and that is why it is important, especially in the topic of water, to refer to firmly defined frameworks, such as those of the United Nations, which in 2015 constituted water as a human right.

Thus, the most important thing with water is: Reduce, Reuse, Recycle! You have different technologies, but the most important thing is that people and humanity become aware that water is our most valuable resource, next to clean air.

DISCLAIMER

Unfortunately, people need to write one of these, even for blogs: All information and data on this website is for informational purposes only (what else would it be for?). I make no representations as to the accuracy, completeness, suitability, or validity of any information. I will not be liable for any errors, omissions, or any losses arising from its display or use. All information is provided AS IS with no warranties and confers no rights.

Because the information on this website is based on my personal opinion and experience, it should not be considered a specific purchase recommendation or professional financial investment advice. I am not liable for any losses incurred as a result of the implementation of the thoughts or ideas.