Till today, the Consumer Price Index in June 2022 showed its sharpest Year-over-Year spike in four decades. In the first place, the FED claimed that the current rise in inflation is transitory and will decline by itself as seen in the previous period. But now as inflation persists there have been a list of “causes” that continue to rotate and keep inflation higher (shortage of construction supplies/used cars/general supply bottlenecks due to pandemic restrictions, just to name a few).

1 Drivers of high Inflation

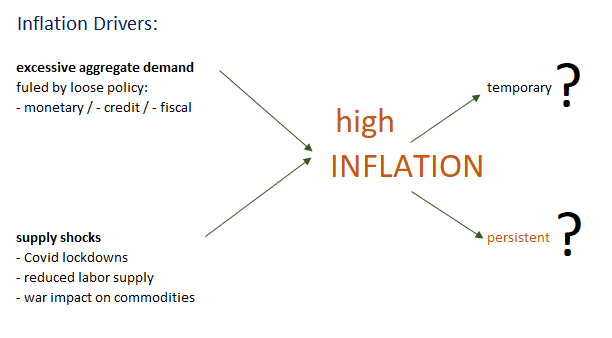

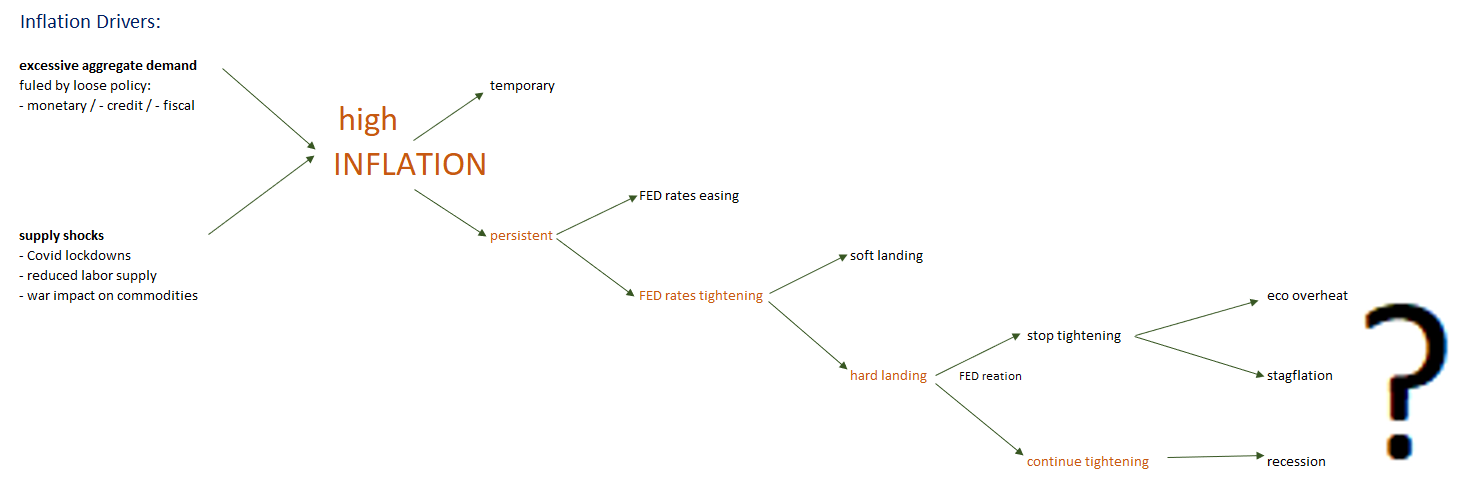

In principle, there are 2 factors opposing each other. On the one side, many analyses are published on supply shocks, driven by labor shortages due to covid lockdowns (up to entire cities in China), less available labor supply, or also effects of the Ukraine war on commodity prices. However, these drivers alone can hardly explain the persistently high inflation compared to other countries above the globe. In particular, when relative prices change, i.e. the shortage of supply of computer chips causes car prices to rise but other prices stay relatively stable.

And on the other side, the outsized demand factor plays an important role stimulated by deficit spending. Due to the recent pandemic and the downturn caused by the lockdowns, central bankers had responded with measures to increase aggregate demand. That demand was fueled by loose monetary, credit and fiscal policies.

Thus, the persistence of inflation could rather be seen as an interplay between demand pull and cost pressures.

Inflation Drivers

2 State of Inflation

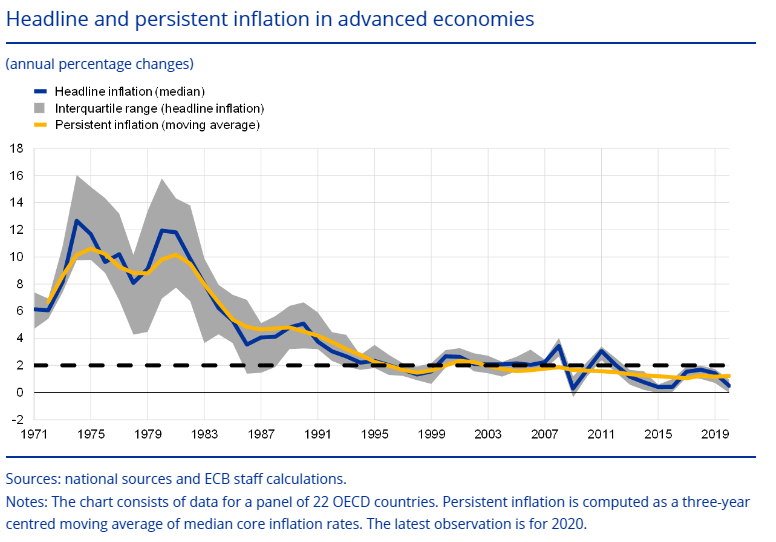

The current inflation rate is the highest it has been since the early 1980s, and central bankers admit they have misjudged the inflation trend in the past. According to the latest report from the Bureau of Labor Statistics, the annual inflation rate in June was 9.1%, the highest level since 1981, based on the Consumer Price Index. Since inflation has been relatively low for quite a long time, especially in developed countries such as the United States and Europe, the inflation levels had been on the screen but rather worried that it would remain too low and rapid price increases seemed like a relic of the past decades. Thus, year-over-year inflation in the United States averaged about 2.3% per month between early 1991 and late 2019. During this period, year-on-year inflation exceeded 5.0% only four times.

Other inflation indicators have also seen significant increases over the past year, although not to the same extent as the consumer price index. Thus, the development of second-round effects, which result from companies and unions having a price-setting ability to pass on prices to customers and raise wages, is being watched closely, as these indicators further increase the general prices of goods and services. Viewed in this light, most assume that the current inflation is a persistent one.

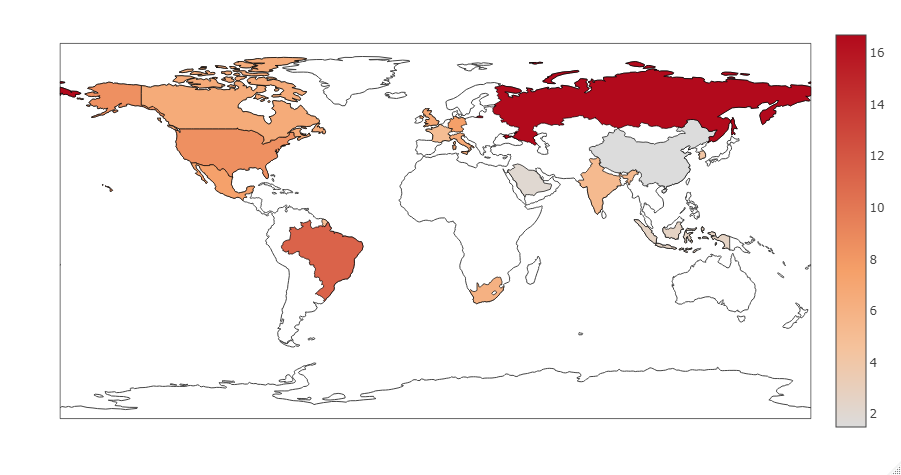

A quick check on the current inflation levels across the G20 countries using the latest complete figures as of March 2022 via the OECD R package. The following code can be used to track the further world’s inflation development:

library(dplyr)

CPI <- OECD::get_dataset("G20_PRICES",

start_time = 2018,

pre_formatted = FALSE)

CPI_filtered <- CPI %>% dplyr::filter(Time == format(Time, format = "%Y-%m"),

!stringr::str_detect(Time,"Q"),

MEASURE == "GY",

!LOCATION %in% c("EA19", "EU27_2020", "G-20"),

stringr::str_detect(Time,"2022"))

# WORLD HEATMAP

CPI_filtered %>%

dplyr::filter(!LOCATION %in% c("ARG","TUR"),

Time == "2022-03") %>%

plotly::plot_ly(type = 'choropleth', locations = ~LOCATION, name = ' ',

z = ~ObsValue,

colorscale = "Reds",

marker = list(line = list(color = plotly::toRGB("black"), width = 0.7)),

text = ~LOCATION,

hovertemplate = paste('<i>CPI</i>: %{z:.2f}%',

'<br><b>Country</b>: %{text}<br>')) %>%

plotly::colorbar(title = 'Inflation YoY', tickprefix = '%')

inflation status March 2022

3 Central Bank Handling

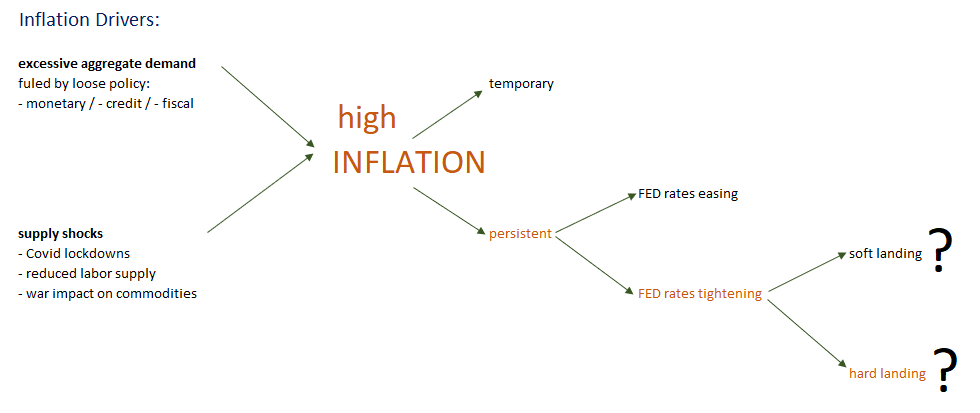

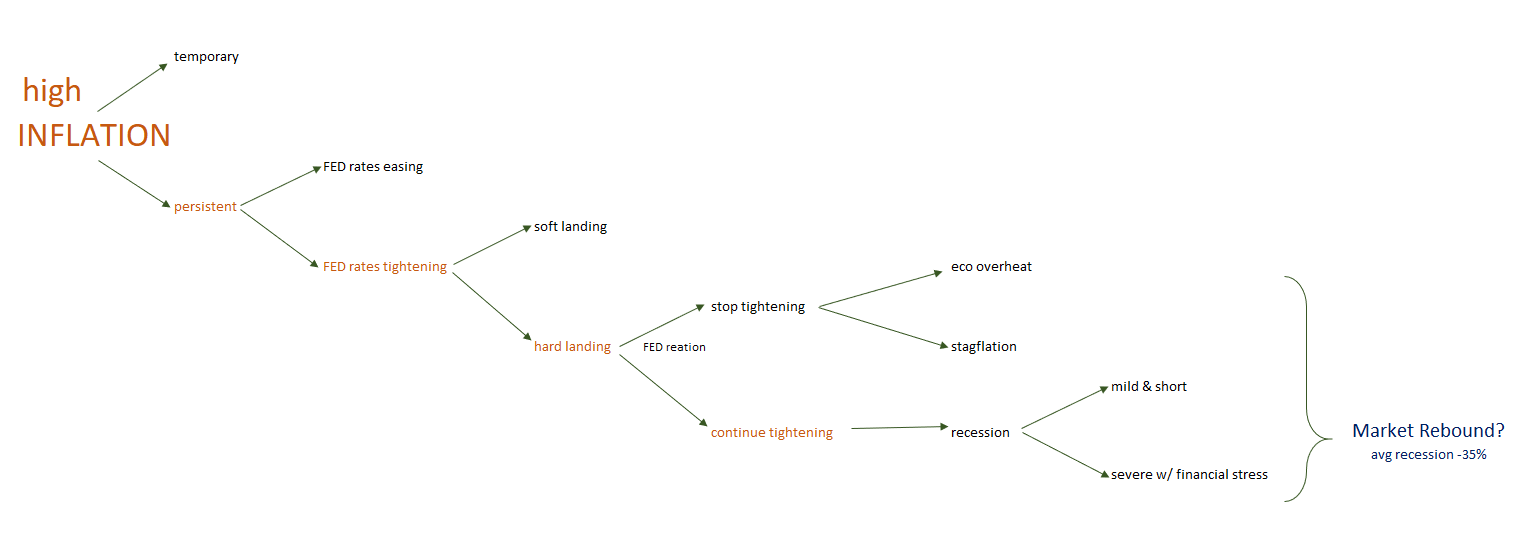

The question that arises when central banks fight inflation is whether they manage to achieve a so-called soft landing of the economy. Here, well-calibrated interest rate hikes are favored so as not to shake the aggregate economic situation. However, there is a risk of falsely assuming the hypothesis of low or temporary inflation and adjusting the interest rate setting too little, so that the unintended price increase continues to spread. However, at the moment, the risk of doing too little far outweighs the risk of mistakenly rejecting the null hypothesis of low inflation and thus constraining the aggregate economy. This is especially true if the inflation is a result of advanced loose monetary policy and an economy at risk of overheating with a supply chain constraint.

Even if the aim is to arrange a soft landing, some leading central banks may have waited too long until they had sufficient evidence that it is not short-term inflation and now run the risk of chasing price pressures.

Supply-driven inflation also tends to have a stagflationary effect and increases the likelihood of a hard landing. The general consensus is swinging to the hard landing scenario, where even Fed chief Powell admits that a soft landing will now be a major challenge. Some prominent Wall Street institutions are already using the hard landing as the basis for their models, as forward-looking indicators point south, such as economic activity and business and consumer confidence.

4 Econimic state

Whether or not the recession comes in the next few months, stagflation is real and has arrived in the U.S., according to leading economists. Thus, the baseline situation is stagflation with broad inflation and slow economic growth, which in turn has shifted the risk balance towards recession.

This puts central banks in another dilemma. Should they stop tightening interest rates because of the increased risk of an economic contraction? The consequence would be further favorable corporate credits, a continued high demand side, with the economy threatening to overheat due to an excess of potential growth. With persistent inflation above market expectations, the economy at least enters stagflation. Depending on whether the dominant factor is on the supply or demand side.

Market expectations remain hawkish on FED rate hikes, at least for now (daily changes in market expectations can be tracked via our market dashboard app !!).

Eventually, the FED will accept higher inflation, followed by stagflation once a hard landing seems inevitable, as there appears to be an increased risk of recession damage, and a debt trap, as increased private and public liabilities have accumulated through the years of low interest rates.

5 Market Reaction

Based on the assumption of a liekly recession, the question is whether it will be mild & rapid, similar to the March 2020 recession, or more severe with considerable financial stress? A mild recession is favored by the fact that the financial imbalance is not as severe as in 2009, while a more severe recession with financial stress is favored by stagflation with the possibility of a debt crisis, as the ratio of GDP level to debt level has risen from 200% in 1999 to 350% currently. As soon as liabilities can no longer be served, zombie households are created, (financial) companies and governments slip into default.

When comparing the current situation with past events, one can see that e.g. 1970: there was stagflation, but no debt crisis 2008: the debt crisis with low inflation or deflation as the credit crunch generated a negative demand shock.

At the moment, there seems to be a stagflation shock in which central banks have to tighten interest rates, even with a risk of recession because the demand side is too high. There is also the peculiarity that this is a global phenomenon.

market rebound?

As always, we are open and appreciate suggestions, exchanges and recommendations either via LinkedIn or info@aikia.org!